Skip the confusion. Get honest answers and personalized solutions from someone who’s been there.

Call Yvonne!

954-646-3666

Let’s find coverage that fits your life and budget. I’ll show you all your options – and potential savings – with no obligation.

Sometimes the Health Insurance Marketplace doesn’t offer the coverage options you’re looking for. Whether you need more flexibility in your provider network, want additional benefits not available through marketplace plans, or don’t qualify for premium subsidies, private off-exchange health insurance provides alternative coverage solutions designed to meet your specific needs and preferences.

At Heaven Insurance Consultants, we understand that every South Florida resident’s health insurance situation is unique. That’s why we specialize in helping you explore private off-exchange options that offer the flexibility and benefits you’re seeking. Our expertise in both marketplace and private insurance ensures you get comprehensive guidance to choose the coverage that truly fits your healthcare needs and budget.

Navigating private health insurance options requires understanding the differences between marketplace and off-exchange coverage. Our expertise in both areas ensures you make informed decisions about your health coverage.

We provide clear education about private off-exchange plans and how they differ from marketplace options. Our team stays current with the latest private insurance offerings, carrier networks, and plan features to ensure you receive accurate, up-to-date guidance that helps you find the right coverage for your situation.

Understanding the real differences between marketplace and private plans can be confusing. We help you compare all available options side by side, looking at coverage benefits, provider networks, prescription coverage, and total costs. This thorough analysis ensures you choose the most appropriate option for your specific healthcare needs.

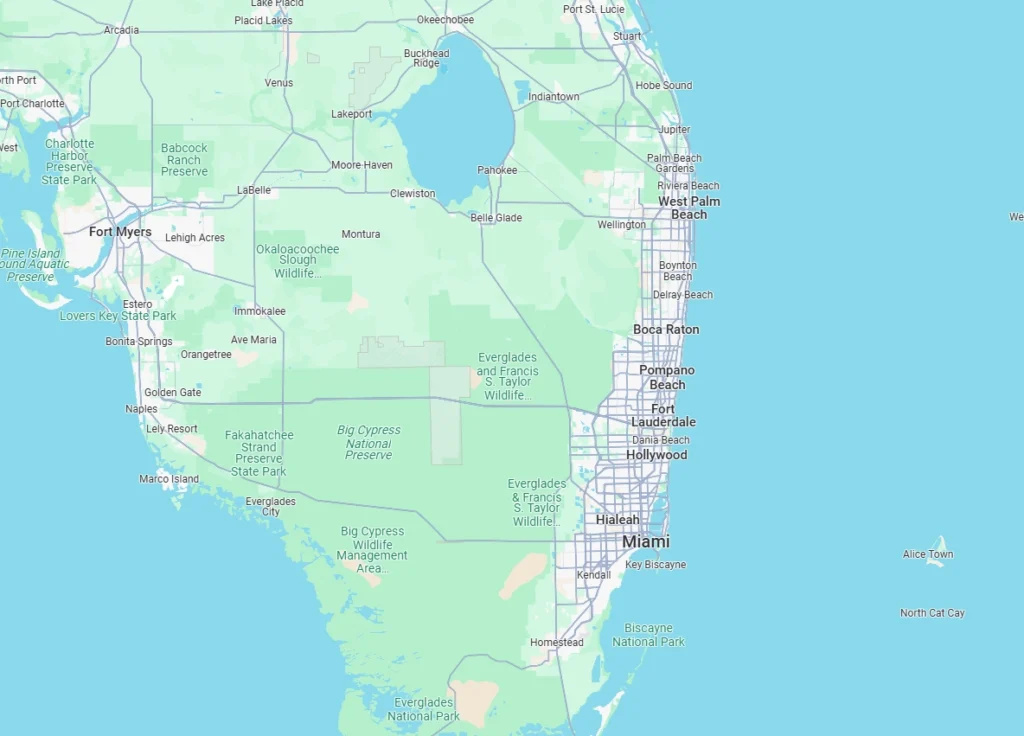

As your trusted South Florida insurance consultants, Heaven Insurance Consultants understands the private insurance landscape in Palm Beach County and surrounding areas. We know which private insurers offer coverage in your area, how their networks compare to marketplace plans, and which options provide the best value for local residents.

We believe in providing comprehensive education about all insurance options available for your health and well-being. Our goal is to ensure your expectations are met in a meaningful, clear manner, so you understand exactly what private off-exchange coverage offers and how it compares to other options.

Our efficient enrollment approach eliminates unnecessary paperwork and confusion while keeping you informed at every step. We handle all the technical details with personalized guidance, ensuring you get the protection you need quickly without typical delays or frustration.

Our relationship doesn't end when you enroll. We provide year-round assistance whenever you have questions about your coverage, need help navigating claims, or want to better understand your benefits. Think of us as your long-term healthcare coverage partner who's always available to ensure you get the most value from your insurance.

We make getting insured simple with a fast, no-fuss process. While we handle the details, you stay informed every step of the way - so you get coverage without waiting.

We’re always available to assist you - day or night. From coverage questions to claims help, our team provides prompt, professional support whenever you need it.

Private off-exchange health insurance refers to coverage purchased directly from insurance companies outside of the Health Insurance Marketplace. These plans offer alternative options for individuals and families who want different benefits, networks, or features than what’s available through marketplace plans.

Private off-exchange coverage works well for South Florida residents who:

Private insurers offer various plan types outside the marketplace, each designed to meet different healthcare needs and preferences.

Understanding the key differences between private off-exchange and marketplace plans helps you make the best decision for your situation.

Marketplace Plans:

Private Off-Exchange Plans:

Marketplace Plans:

Private Off-Exchange Plans:

Marketplace Plans:

Private Off-Exchange Plans:

Choosing the right private health insurance requires careful evaluation of multiple factors beyond just premium costs.

Consider what matters most to you:

Look at the complete cost picture:

Ensure access to your preferred healthcare providers:

Understand what each plan covers:

Maximize the value of your private off-exchange health insurance by understanding how to use your benefits effectively.

Take time to learn about your specific coverage:

Take advantage of wellness services:

Make informed decisions about your care:

Keep up with plan updates and changes:

Private off-exchange plans are health insurance policies purchased directly from insurance companies outside of the Health Insurance Marketplace. These plans offer alternative coverage options with different benefits, networks, or features than marketplace plans, providing more choices for individuals seeking specific types of coverage.

Private off-exchange plans may offer different benefit combinations, provider networks, and plan features than marketplace options. They don't qualify for premium tax credits or cost-sharing reductions, but may provide access to broader networks, additional benefits, or plan designs not available through the marketplace.

Private plans work well for people who don't qualify for marketplace subsidies, need specific providers not available in marketplace networks, want additional benefits beyond essential health benefits, or prefer more flexibility in their coverage options and plan design.

Many private off-exchange plans offer more flexible enrollment periods than marketplace plans. However, enrollment rules vary by insurer and plan type. Some plans allow year-round enrollment, while others may have specific enrollment periods or requirements.

Coverage for pre-existing conditions varies by plan type and insurer. Traditional private health plans typically provide coverage similar to marketplace plans, while short-term plans may have different rules. It's important to understand each plan's specific coverage guidelines.

Costs vary depending on the specific plan and your situation. While private plans don't offer federal subsidies, they may have different premium structures. The total cost comparison depends on your eligibility for marketplace assistance and the specific benefits you're seeking.

You can typically switch to marketplace coverage during Open Enrollment or if you qualify for a Special Enrollment Period. However, you should carefully compare the benefits, networks, and costs of both options before making changes to ensure the new coverage meets your needs.

Consider your healthcare needs, budget, preferred providers, and coverage priorities. Compare the benefits, networks, and costs of private plans with marketplace options. Heaven Insurance Consultants can help analyze your situation and recommend the most appropriate coverage for your specific needs.

Evaluate the provider network, covered benefits, cost structure, prescription coverage, and any additional features. Make sure your preferred doctors and hospitals are included, understand the claims process, and verify that the coverage meets your healthcare needs and budget requirements.

Yes, Heaven Insurance Consultants provides expert guidance for private off-exchange plans. We help you compare options, understand benefits, navigate enrollment, and provide ongoing support. Our no-cost consultation helps you evaluate whether private coverage is the right choice for your situation.

Finding the right health insurance doesn’t have to be limited to marketplace plans. Heaven Insurance Consultants specializes in helping South Florida residents explore all their coverage options, including private off-exchange plans that may better meet their specific needs.

Our private insurance expertise includes:

Don’t limit yourself to only marketplace options if they don’t meet your needs. Contact Heaven Insurance Consultants today to explore private off-exchange plans and discover coverage that truly fits your healthcare priorities and budget.

Ready to explore private health insurance options? Contact Heaven Insurance Consultants ☎️ +1 (954)646-3666 for your free consultation and personalized coverage analysis.

Heaven Insurance Consultants proudly helps individuals and families throughout South Florida explore both marketplace and private health insurance options. Our comprehensive understanding of Palm Beach County’s insurance landscape ensures you receive expert guidance on all available coverage types.

We serve residents of Boynton Beach, Delray Beach, Boca Raton, West Palm Beach, Wellington, Lake Worth Beach, Lantana, Ocean Ridge, and surrounding South Florida communities. Our local knowledge of area healthcare networks helps you choose coverage that works with your preferred providers.

Contact us today to learn how Heaven Insurance Consultants can help you discover the health insurance solution that best meets your unique needs and priorities.