Skip the confusion. Get honest answers and personalized solutions from someone who’s been there.

Call Yvonne!

954-646-3666

Let’s find coverage that fits your life and budget. I’ll show you all your options – and potential savings – with no obligation.

Finding the right health insurance can feel overwhelming, especially when you’re shopping on your own. Whether you’re self-employed, recently lost job coverage, or simply want better options than what your employer offers, individual health insurance gives you the freedom to choose coverage that truly fits your needs and budget.

At Heaven Insurance Consultants, we understand that every South Florida resident’s health insurance needs are unique. That’s why we take the time to explain your options clearly and help you discover personalized health coverage that protects both your health and your wallet. With our no-cost consultation and ongoing support, you’re never alone in navigating the complex world of health insurance.

Selecting health insurance shouldn’t be confusing or stressful. Our approach focuses on education and transparency, ensuring you understand exactly what you’re getting before you commit to any plan.

We believe in explaining health insurance in simple terms that make sense. No confusing jargon or high-pressure sales tactics – just honest conversations about what each plan offers and how it matches your specific situation. We compare plans side by side, highlighting the real differences in coverage, costs, and benefits so you can make informed decisions.

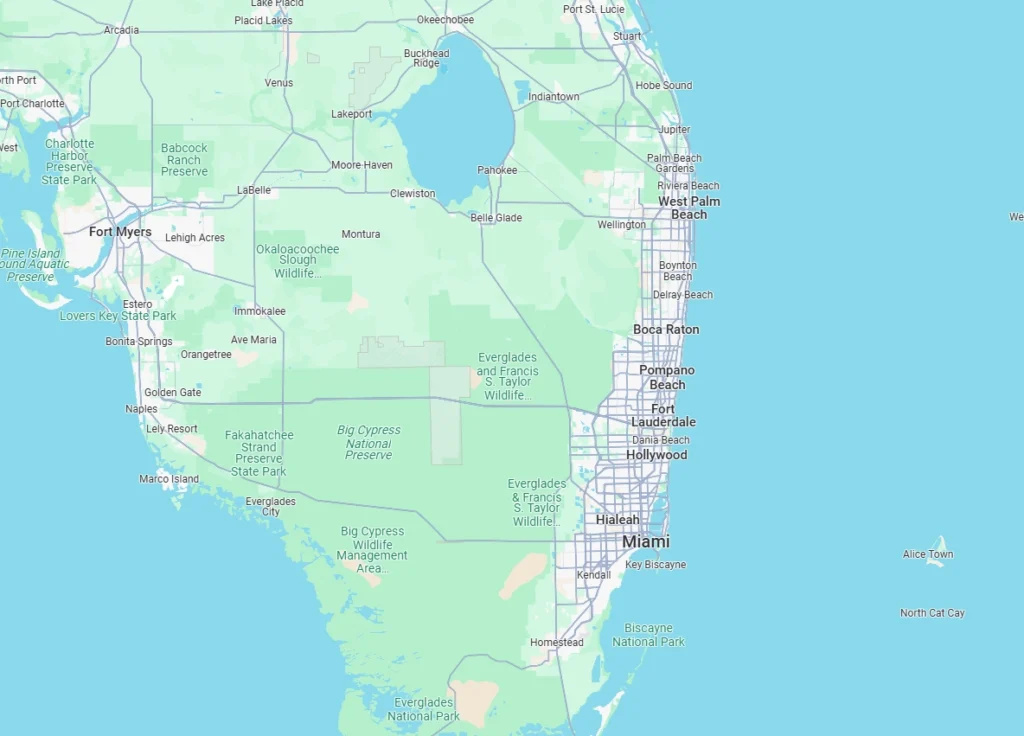

As your local South Florida insurance consultants, Heaven Insurance Consultants stays current with state-specific regulations, plan changes, and healthcare networks throughout Palm Beach County and surrounding areas. This local knowledge ensures we recommend plans that work well with South Florida hospitals, medical groups, and healthcare providers in your area.

We provide comprehensive education that helps you understand all the benefits and programs available for your health and well-being. Our goal is to ensure your expectations are met in a meaningful, clear manner, so you feel confident about your coverage choices.

Individual health insurance puts you in the driver's seat. You can customize your plan based on your healthcare needs, preferred doctors, and budget. This flexibility means your insurance works for you, adapting to your life rather than forcing you to adapt to limited options.

Our efficient enrollment process eliminates unnecessary paperwork and confusion. We handle the technical details while keeping you informed every step of the way, ensuring quick policy setup without delays.

Our relationship doesn't end when you enroll. We provide year-round assistance with claims questions, finding network providers, and navigating changes during open enrollment. Think of us as your long-term healthcare coverage partner who's always available when you need help.

We make getting insured simple with a fast, no-fuss process. While we handle the details, you stay informed every step of the way - so you get coverage without waiting.

We’re always available to assist you - day or night. From coverage questions to claims help, our team provides prompt, professional support whenever you need it.

Individual health insurance is coverage you purchase directly for yourself and your family, independent of employer benefits. This type of coverage provides essential financial protection against medical expenses while ensuring access to quality healthcare services.

Understanding your plan options helps you make the best coverage decision for your situation:

Health Maintenance Organization (HMO)

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

The Health Insurance Marketplace provides the main avenue for purchasing individual health insurance in South Florida. Understanding how it works helps you find affordable coverage that meets your needs.

Open Enrollment typically runs from November 1 through January 15 each year. During this period, you can:

Coverage generally starts January 1 if you enroll by December 15.

Certain life events allow you to enroll outside Open Enrollment, including:

You typically have 60 days from the qualifying event to enroll in coverage.

Health insurance plans are grouped into metal tiers that show how costs are shared between you and the insurance company:

Bronze Tier Plans

Silver Tier Plans

Gold Tier Plans

Platinum Tier Plans

Understanding health insurance costs helps you budget effectively and choose the right level of coverage for your situation.

Your premium is what you pay each month to keep your coverage active, whether you use healthcare or not. Premium amounts depend on:

Your deductible is the amount you pay for covered services before insurance starts helping with costs. Lower premium plans usually have higher deductibles. Many preventive services are covered before you meet your deductible.

Copayments are flat fees you pay for specific services. You might have different copays for primary care visits, specialist appointments, and prescription medications. These fixed amounts help make your healthcare costs more predictable.

After meeting your deductible, coinsurance is your share of costs, shown as a percentage. You pay your percentage while insurance covers the rest. This cost-sharing continues until you reach your annual out-of-pocket maximum.

This is the maximum you’ll pay for covered services in one year. Once you reach this limit, insurance pays 100% of covered services. This protection prevents medical bills from becoming financially devastating.

Many South Florida residents qualify for financial assistance to make health insurance more affordable. Two main programs help reduce costs through the Marketplace.

These monthly subsidies lower your premium costs. You may qualify if you:

You can use credits monthly to reduce premiums or claim them when filing taxes.

These programs reduce your deductible, copayments, and coinsurance if you:

Cost-sharing reductions lower your out-of-pocket expenses when you need care.

Financial assistance is available at various income levels, based on federal poverty guidelines updated annually. Many middle-class families are surprised to discover they qualify for help. During your no-cost consultation with Heaven Insurance Consultants, we can determine your eligibility and estimate your actual costs after assistance.

Current federal law ensures that insurance companies cannot:

This protection applies to all Marketplace plans and most individual policies, guaranteeing access to coverage regardless of your medical history.

All Marketplace plans must include these ten essential health benefits:

These requirements ensure comprehensive coverage for most healthcare needs.

Choosing the right health insurance requires evaluating several important factors:

Consider:

Look at both premium and out-of-pocket expenses:

Make sure your preferred doctors, specialists, and hospitals accept the plan. Out-of-network care typically costs much more or may not be covered.

Look beyond basic coverage to understand:

Get the most value from your coverage by understanding how to use it effectively:

Most plans cover preventive services at no cost to you, including:

Use these services regularly to stay healthy and catch problems early.

Using network providers saves money. Before getting care:

Reduce medication expenses by:

Use the right type of care to manage costs:

Individual health insurance is coverage you buy directly from an insurance company or through the Health Insurance Marketplace. Unlike group plans from employers, you select and pay for this coverage yourself. These plans provide financial protection against medical expenses while ensuring access to healthcare services.

Individual health insurance works well for people who:

You can enroll during:

Coverage typically starts the first day of the month after you enroll.

Costs depend on several factors:

Many people qualify for premium tax credits that significantly reduce monthly costs. Heaven Insurance Consultants can help calculate your actual costs after available financial assistance.

Whether you can keep your doctors depends on which plan you choose. Each plan has its own network of providers. Before enrolling, we help verify that your preferred doctors and hospitals are included in the plan's network.

All Marketplace plans cover essential health benefits including doctor visits, hospital care, emergency services, prescription drugs, preventive care, mental health services, and more. Specific coverage details vary by plan, but all provide comprehensive protection.

Premium tax credits reduce your monthly insurance costs based on your household income. Cost-sharing reductions lower your deductibles and copayments. These programs make health insurance affordable for individuals and families with income up to 400% of the federal poverty level.

Insurance companies cannot deny coverage or charge more because of pre-existing health conditions. All plans must cover treatment for pre-existing conditions without waiting periods, so you can get the care you need.

HMO plans typically cost less but require staying within a specific network and getting referrals for specialists. PPO plans cost more but offer flexibility to see any provider without referrals. Your choice depends on whether you prioritize lower costs or maximum flexibility.

Consider your healthcare needs, budget, preferred providers, and prescription medications. Compare total costs including premiums and potential out-of-pocket expenses. Heaven Insurance Consultants helps analyze these factors to recommend plans that best match your specific situation.

Finding the right individual health insurance doesn’t have to be complicated or stressful. Heaven Insurance Consultants specializes in helping South Florida residents navigate their coverage options with personalized guidance and ongoing support.

Our services include:

Don’t risk going without health coverage or overpaying for insurance that doesn’t meet your needs. Contact Heaven Insurance Consultants today to explore your options and secure the protection you deserve.

Ready to discover personalized health coverage? Contact Heaven Insurance Consultants ☎️ +1 (954)646-3666 for your free consultation.

Heaven Insurance Consultants proudly helps individuals and families throughout South Florida find quality, affordable health insurance solutions. Our deep understanding of Palm Beach County’s healthcare landscape and insurance market ensures you receive coverage recommendations that work in your community.

We serve residents of Boynton Beach, Delray Beach, Boca Raton, West Palm Beach, Wellington, Lake Worth Beach, Lantana, Ocean Ridge, and surrounding South Florida communities. Our local knowledge of area healthcare providers ensures you get coverage that works with your preferred doctors and hospitals.

Contact us today to learn why South Florida residents trust Heaven Insurance Consultants for their health coverage needs.